Give Your Worthy Grad a Financial Boost!

Building a strong financial base with Worthy Bonds that earn a fixed _xx% APY is an ideal graduation gift

Give Your Grad a Financial Boost with Worthy Bonds!

Building a strong financial base with Worthy Bonds that earn a fixed _xx% APY is an ideal graduation gift

Why Bonds are a Worthy Option

Worthy Bonds are a great way to grow your wealth. We created and sell SEC-

qualified bonds that help fuel American communities while offering a _xx% APY yield to

you - with no fees, and access to your funds at any time.

This is investing you can feel good about.

$200,000,000 in Bonds Sold*

*Bonds sold by all Worthy subsidiary issuers

Bonds are only $10 each

_xx% APY fixed interest until _expdate

No fees or penalties

Compound interest daily

Portfolio diversification

Community impact

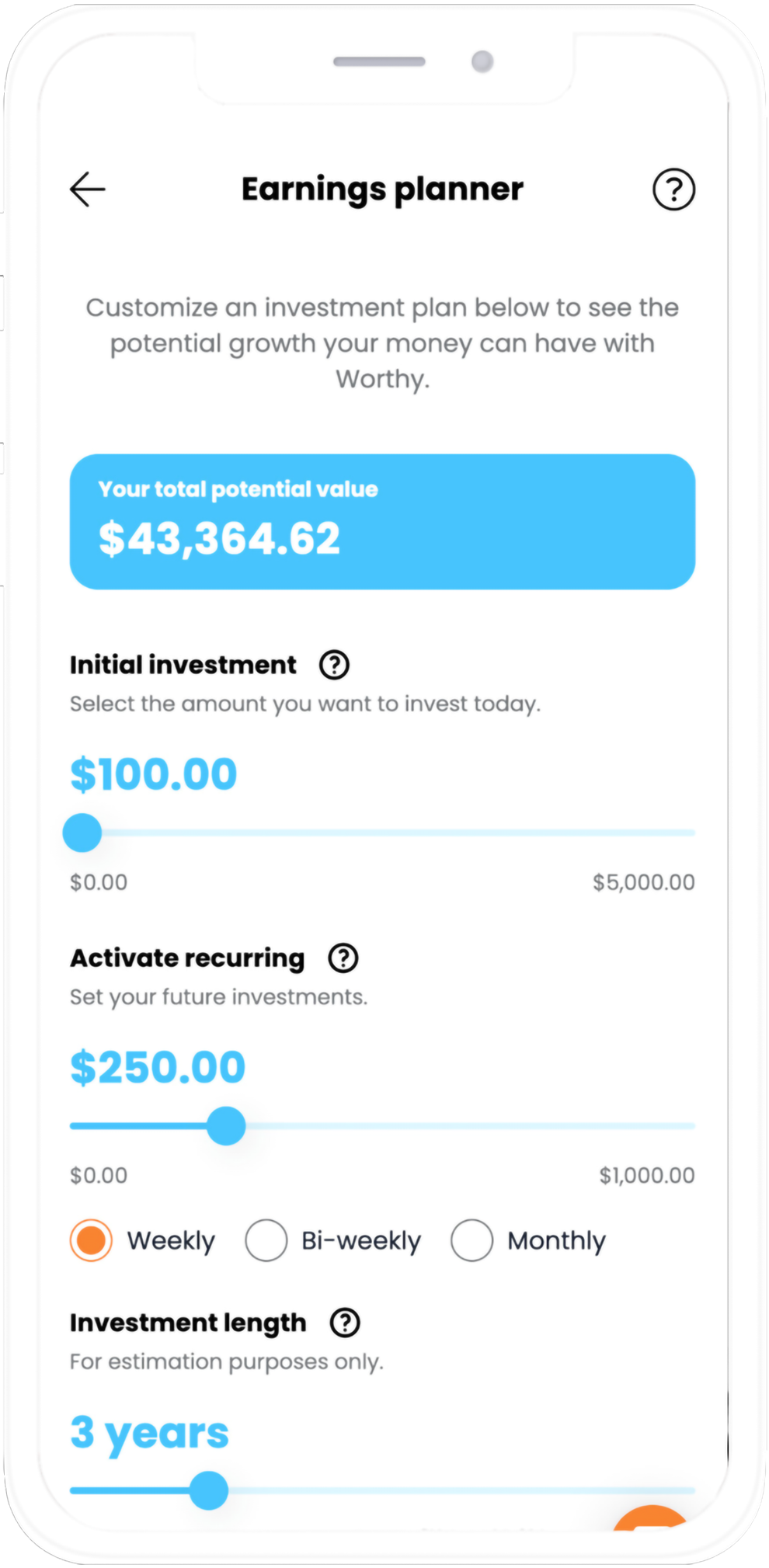

Initial investment

Whether it's $10, $1,000 or more, choose your initial investment to get started.

Length

Watch our _xx% APY interest go to work for you by choosing a length of time to hold your investment.

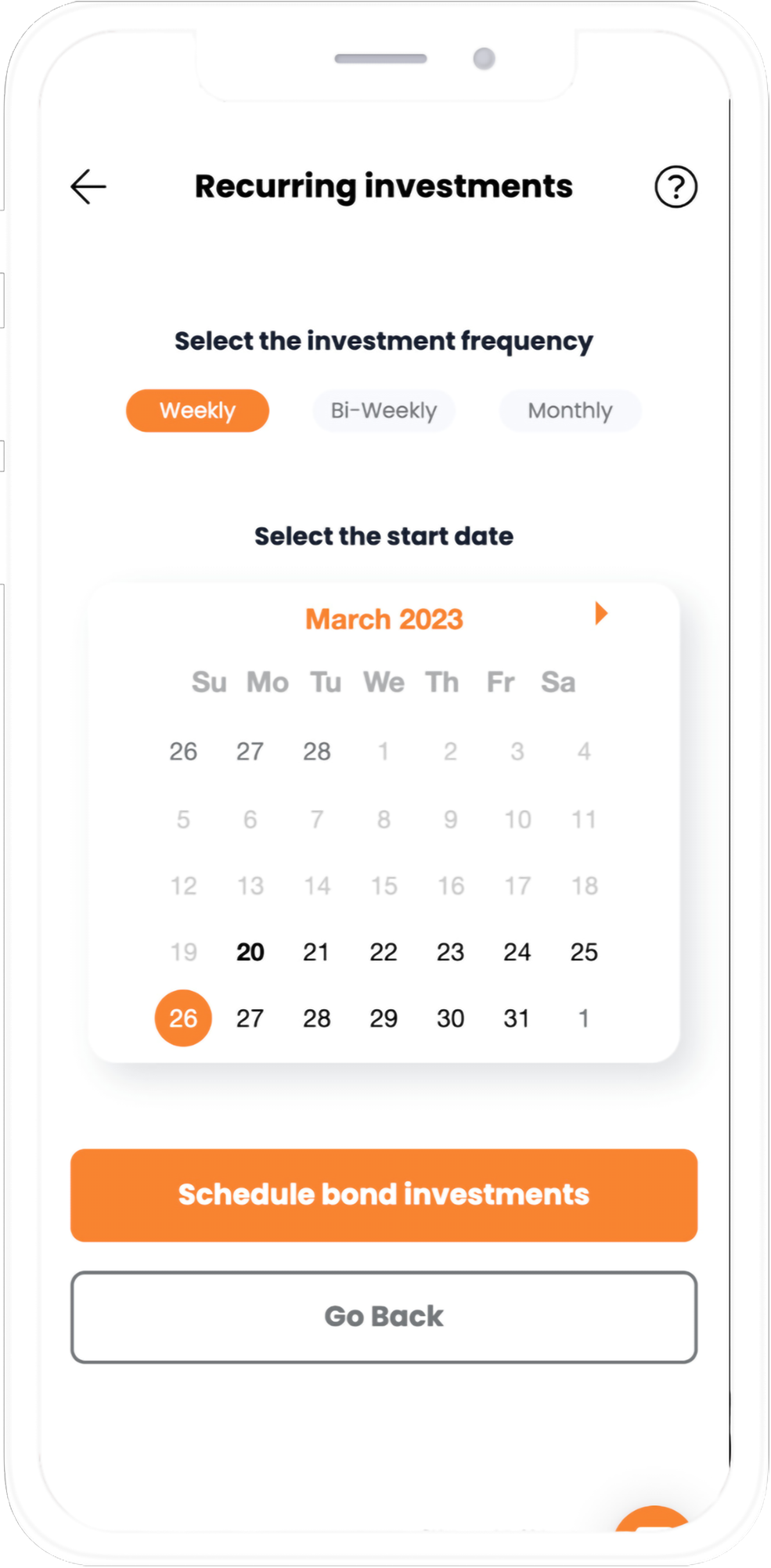

Auto purchase

Take investing off your to do list. Schedule how much and how often you want to purchase bonds and let us do the rest!

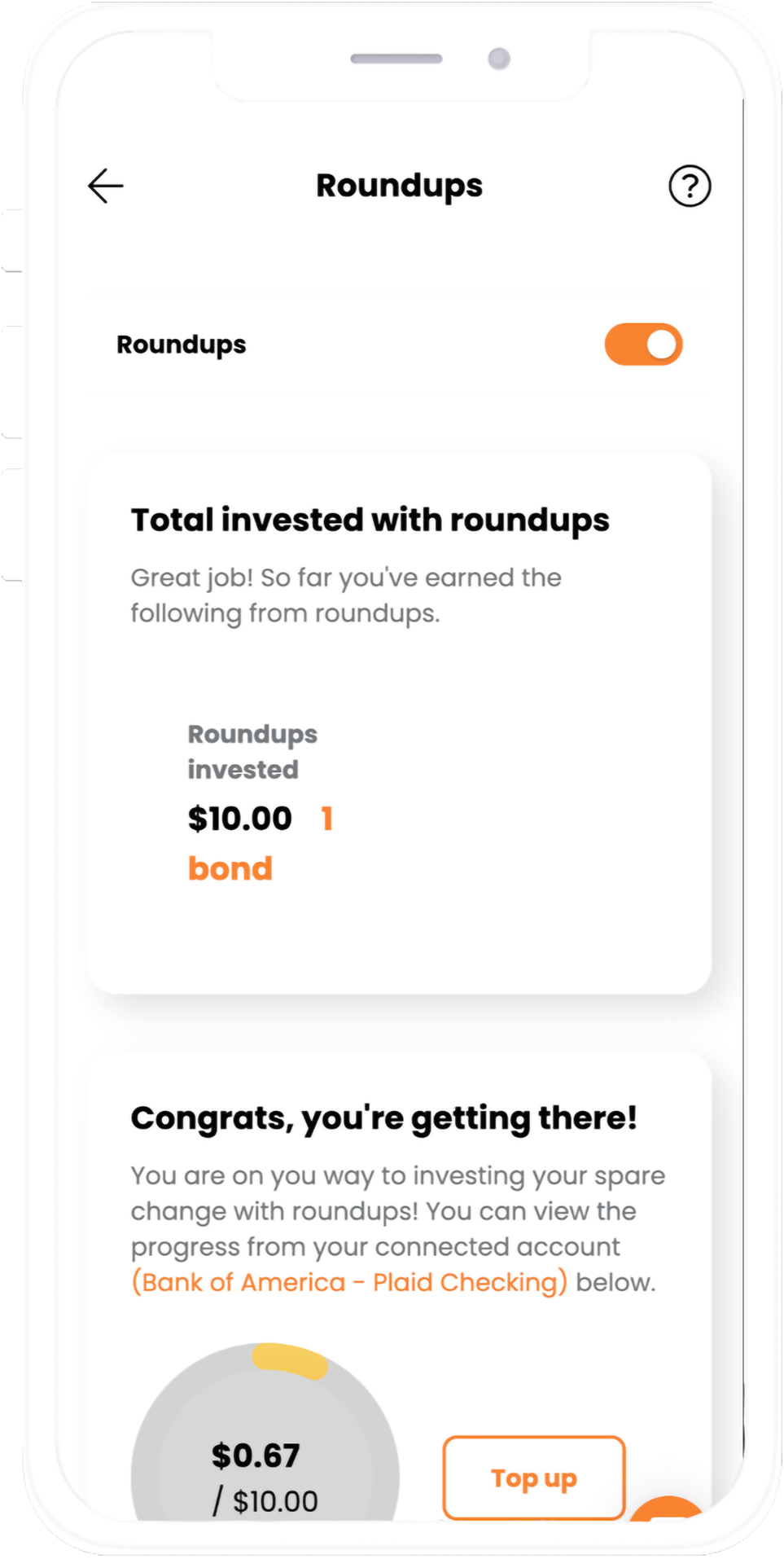

Roundups

Make the most of your "spare change." We can round-up your everyday purchases to the next whole dollar and automatically invest this “spare change” in a $10 bond.

Over 100,000 American Households have

already joined our Worthy Community

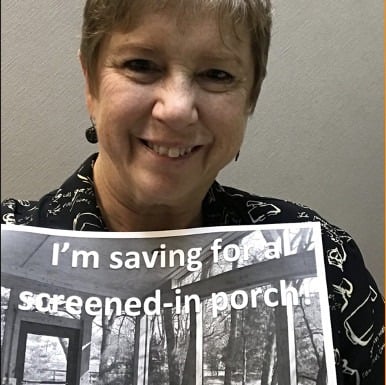

A Worthy community

We call our customers “Worthies” and every day we get messages telling us how our platform has helped them on their financial journey. Whether that is creating a rainy day fund, paying off students loans, or taking that trip they’ve been dreaming about.

Explore our community

A Worthy Community

We call our customers “Worthies” and every day we get messages telling us how our platform has helped them on their financial journey. Whether that is creating a rainy day fund, paying off students loans, or taking that trip they’ve been dreaming about.

Learn More

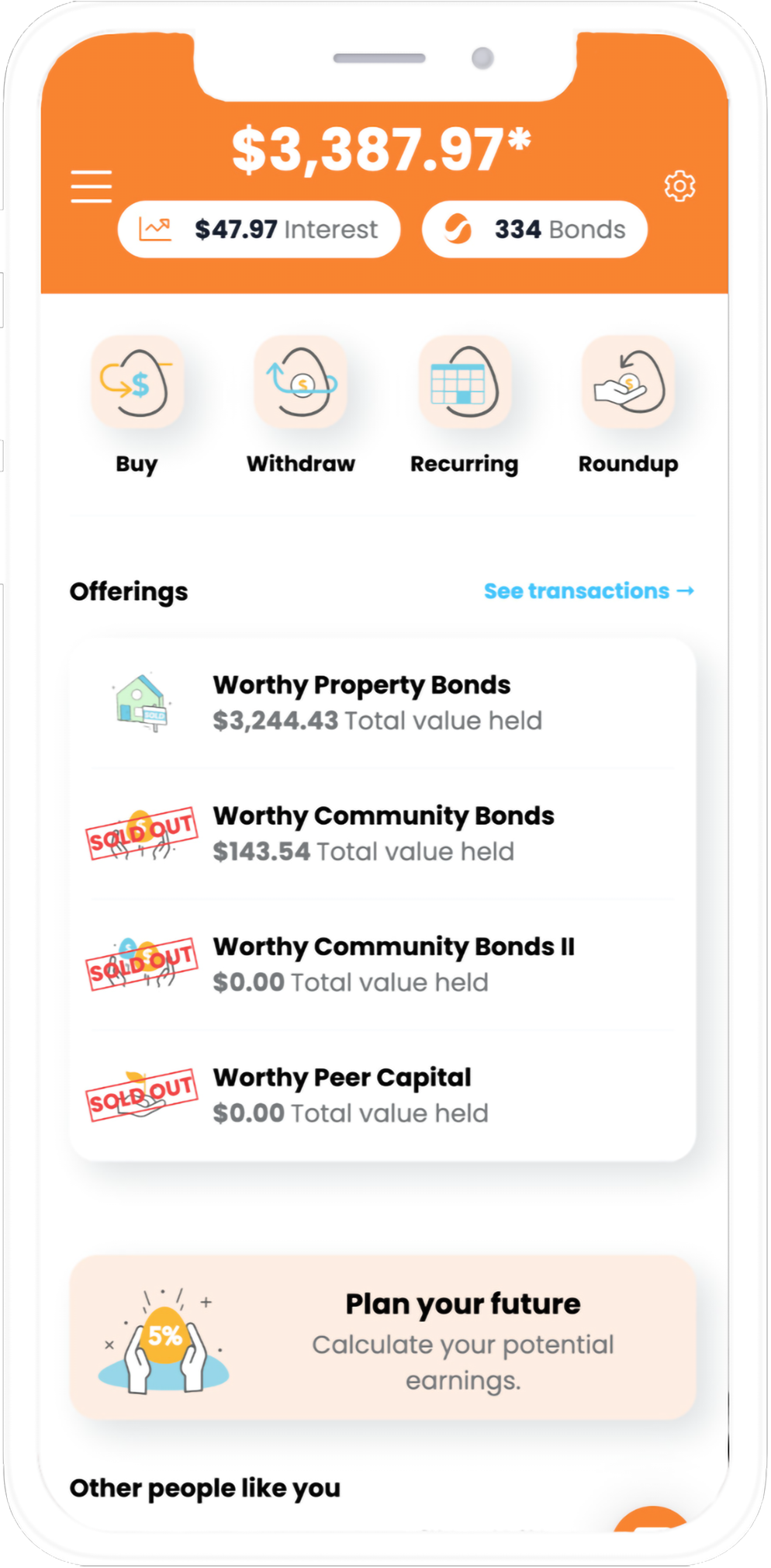

Dashboards

Portfolio and Community Dashboards at your finger tips.

Planning calculator

See how much you can earn and get excited about your savings goals!

Auto Purchase

Schedule how much and how often you want to invest in our bonds and let us do the rest!

Roundups

Roundup your everyday purchases to the next whole dollar and automatically invest this "spare change" in a $10 bond.

Download our app!

I am WorthyTM of a great financial future.

Never miss an update!

Sign up for our monthly financial advice newsletter and exclusive updates. We never share your email with third parties.